Financial processes are an integral part of an enterprise; their horizontal nature touches the entire organisation, they generate extensive amounts of data and carry the potential to identify performance issues, predict scenarios and change business outcomes.

Automation is key to unlocking such potential, but knowing exactly what to automate across your financial processes and what technologies are most suitable is key towards achieving impactful change.

The future of the finance function

Traditionally, enterprises delegated financial processes externally via outsourcing as a way to cost-effectively filter out high volume, low-value tasks. We are starting to witness automation’s role in allowing for such tasks to return in-house, and in turn, shake up the developing world’s information technology industry. World Bank estimates that 69% of today’s jobs in India are under threat because of automation, with China seeing a staggering 77% of jobs at risk.

According to Microsoft, organisations already using automation technologies at scale are performing an average of 11.5% better than those who are not – up 5% from the previous year (2018). Automation can propel transformation behind the scenes with a higher level of speed, scale and accuracy than outsourcing could ever offer (as outsourcing relies on large teams of specialists, prone to error due to language barriers or fatigue, completing manual tasks).

Automation is a more effective option, allowing the ability to scale capabilities, generate higher quality output at greater speed, boost security and overall accuracy (which improves the customer experience). It also allows you to reserve higher-quality, value-focused tasks for your human workforce.

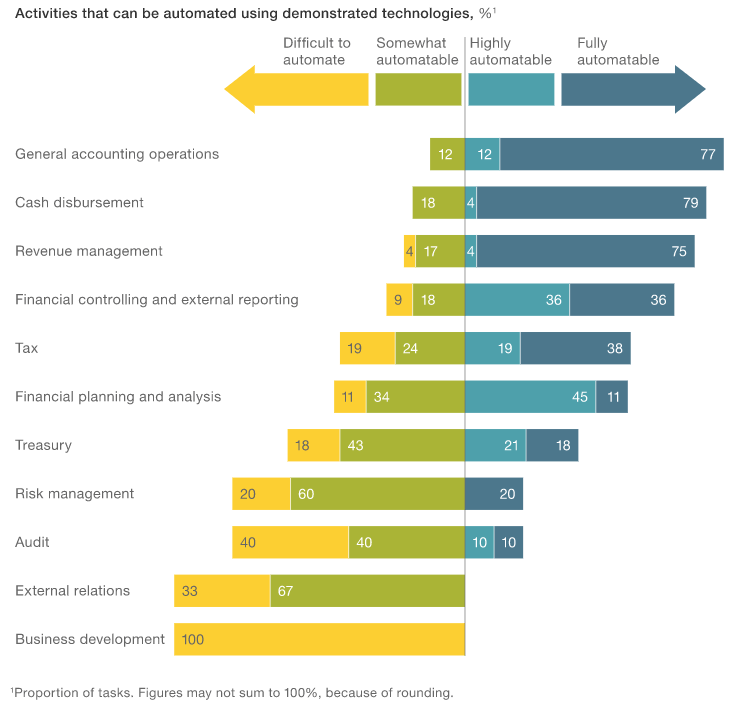

What exactly can be automated within your finance function depends on the nature of the task. McKinsey has illustrated (see below) that up to 42% of financial processes can be fully automated, with about a third of the opportunity for automation captured using task automation technologies such as robotic process automation (RPA). The remainder requires cognitive automation technologies, such as intelligent automation (IA).

Image source: Bots, algorithms, and the future of the finance function, McKinsey 2018

RPA is best suited to automate high volume, repetitive, rules-based financial process tasks, such as general accounting operations that are governed by business logic and structured inputs. Intelligent automation can then sweep up more complex decisions that are out of reach for RPA. Intelligent automation is better suited to more high value, transactional decisions, that typically rely on a human to make a decision, such as the screening of R&D tax claim judgements or payment sanctions.

It can be common across departments, and even functions within departments, to operate using disparate technology systems. But this structure will inevitably lead to errors, due to data overlap or misinformation, or hinder digital transformation due to integration issues. Given the horizontal nature of financial processes (i.e. spanning multiple functions), alignment is imperative.

Utilising the compounding efficacy of a portfolio solution that combines RPA and intelligent automation, provides a truly end-to-end automation solution. One that seamlessly allows for knowledge sharing and operational alignment, across functions and departments.

Making end-to-end finance process automation a reality

A great working example of a truly end-to-end automation solution is delivered by Rainbird and RPA provider Blue Prism. This integrated tool adds a layer of complex and high-value decision-making to RPA’s typical process automation capabilities. Essentially, your “thinking” tasks can be automated in synchronicity with “doing” tasks.

Blue Prism bots normalise and move records from one place to another, while Rainbird’s intelligent automation decides what needs to be done about those records. Alternatively, Rainbird can make decisions about the implications of data, and then tell the Blue Prism bots how to tag or where to move the data.

Take the highly repetitive, rules-based process of payment sanctions screening. A bank system will generate an AML alert, Blue Prism will collect the alert and automate data gathering to classify the alert, while Rainbird will provide an automated assessment and return a percentage of certainty in its decision as to whether the alert is a ‘potential crime’ or a ‘false positive’. Rainbird will send this decision back to Blue Prism, which then actions the decision – if it is a ‘false positive’, the payment is automatically released, but if it is a ‘potential crime’, an alert is escalated to a human for further investigation. All this takes place within seconds and with a high level of accuracy and explainability.

End-to-end automation can service many different needs within the finance function, introducing unprecedented speed, accuracy and scale to high volume tasks.

Making financial data-driven decisions responsibly

Microsoft research found that half (51%) of financial services leaders say they do not know what to do if they disagree with an AI application’s course of action while nearly three in five (59%) admit they are unaware of how the technology reaches its conclusions.

This begs the question as to how a CFO could possibly know if the technology is doing what they need it to and how they can step in and correct things if it is not.

When choosing an end-to-end automation solution, transparency is key, especially as regulators are casting a sharper eye over financial processes. The Rainbird and Blue Prism end-to-end solution is fully explainable to the end-user – and you do not have to be a data scientist to interpret the results. Every decision it makes comes with a full audit trail, explaining the whole chain of reasoning it went through, all the data used and the various uncertainties involved.

To get a deeper understanding of how Rainbird’s intelligent decision automation and Blue Prism’s RPA combine to deliver end-to-end automation, watch our latest webinar in full here.