In recent years several high profile fraud cases have stunned regulators and eroded the public’s trust in banking institutions. Take the case of Danske Bank, a large Scandinavian bank involved in an 8-year international money laundering scheme that overlooked €200 billion in payments flowing through the non-resident portfolio of the group’s Estonian branch. This begs the question as to why know your customer (KYC) processes failed to prevent such an oversight.

KYC is a precautionary measure taken by regulated firms to prevent fraudulent activities and has become an integral component of banks’ fraud prevention efforts. It is mandated and essential for confirming the identities of customers during onboarding and throughout their ‘customer lifetime’, as well as verifying their suitability and any financial crime risks they might pose.

A study commissioned by the European Parliament claims that fraud has cost the EU up to €990 billion a year in losses to gross domestic product. In response, stringent regulations to tackle tax evasion and corruption have meant that KYC’s remit has been extended to include continuous monitoring, fraud management, sanctions management and anti-money laundering.

Complying with KYC obligations has always been the responsibility of banks, where KYC capabilities have been developed reactively to meet regulatory mandates. This approach has led to cumbersome processes, fragmented not only across divisional silos but also functional silos within divisions. This is not only an unsustainable model, it puts the burden on the most important and fragile elements; your customers and the customer experience (CX).

How poor KYC can directly impact the customer experience

KYC onboarding is the crucial first step a bank goes through when acquiring lifetime clients. It consists of multiple touchpoints involving various departments, such as operations, legal and compliance. A poor KYC experience has been found to directly affect the customer experience, with adverse effects on your bank’s bottom line. The following are some ways CX is directly impacted by inept KYC.

Repetitive and unnecessary requests for information

KYC checks can be invasive during customer onboarding, with banks asking customers for a multitude of documents and personal information (mandated by AML regulations) to build an accurate customer profile. According to a study conducted by Forrester Consulting, customers were contacted on average 10 times during the onboarding process and asked to submit between five and up to 100 documents.

Not only does a poor onboarding experience frustrate your customers, but many people are concerned about how their data is being used, collected and stored. In a Cisco-led survey, it was found that 43% of consumers do not believe they can adequately protect their data.

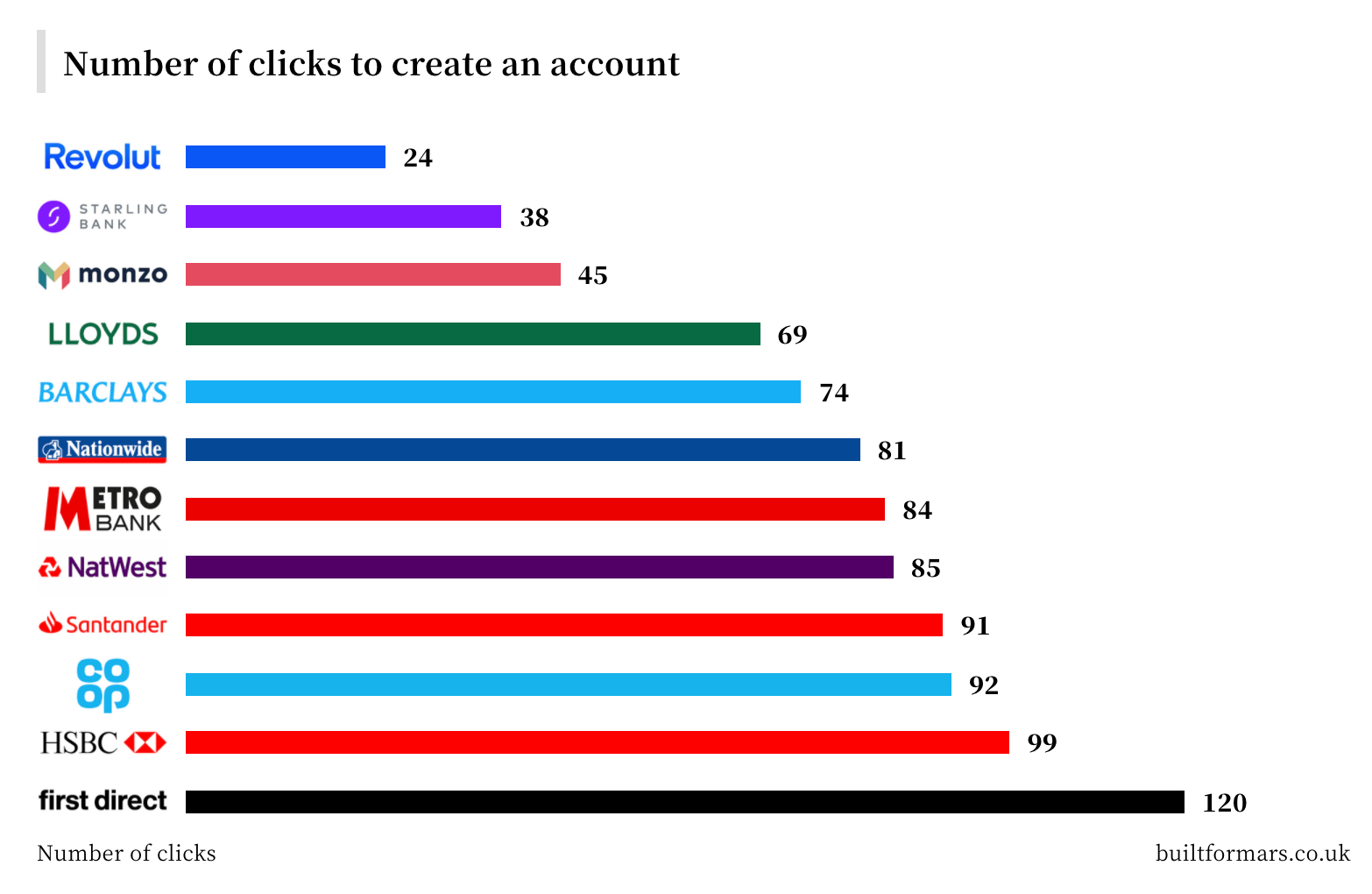

To eliminate such a problematic hurdle during KYC onboarding, challenger FinTech banks (such as Revolut and Starling) are surpassing traditional retail banks by reducing the number of touchpoints during the onboarding process.

Source: https://builtformars.co.uk/banks/opening/

Rising costs of manpower

Not surprisingly, McKinsey stated that “in the United States, anti–money laundering (AML) compliance staff have increased up to tenfold at major banks over the past five years or so.”

Banks are adding staff to vulnerable areas that are in turn causing disjointed KYC efforts across departments, within a single institution. This can mean that customers will be periodically contacted for the same information to fulfil KYC requirements multiple times—leading to duplicated efforts among banking staff and a recurring nightmare for customers.

The kind of acceptable information can also vary depending on the country and the bank, with some institutions requiring a face-to-face meeting to fulfil KYC obligations. This can be a burden on clients who operate across different countries.

Fragmented storage of customer data

Customer information can also be stored in different systems, departments and even branches. How do we know banks’ KYC records are accurate, if customer data are stored and periodically refreshed in silos that do not seamlessly interact?

This can increase the chances of fraud. If you lack the infrastructure to form an accurate picture of your customer, to begin with, how will you know if you’re letting in a fraudster? Fraud not only causes reputational damage to banks, affecting revenue and growth prospects, but it can also have a direct impact on your customers’ lives. It can affect a victim’s credit rating or result in debt (due to stolen money).

Binary decision-making breeds inaccuracy

Banks currently using linear, rules-based KYC/AML automation systems may be doing more harm than good, as well as putting themselves and their customers at a higher risk of fraud. Such systems have been found to generate up to 90 percent false positives with vulnerabilities that can be exploited through approaches like ‘smurfing’, due to the simple nature of the rules used.

Ongoing KYC as a replacement

The latest EU Anti-Money Laundering Directive (AMLD5) has made it a requirement for KYC to be an ongoing activity. This means some banks cannot accept certain types of customers, as performing KYC on them would be too expensive. This means closing the door on potential revenue.

Concurrently, ongoing KYC is likely to further inflate compliance costs. A study by Bain & Co. estimates that risk, governance and compliance costs account for 15-20% of the total “run the bank” cost base, among major banks.

With compliance costs becoming so high, banks may struggle to perform day-to-day functions and customer-focussed investments may be deprioritised. But this pattern doesn’t need to be the one that plays out.

Making ongoing KYC the backbone of CX

As we move towards an era of open banking, KYC onboarding will be managed within a connected, intelligent decision automation ecosystem. Intelligent decision automation refers to machines performing “thinking tasks”, which would otherwise require human intervention, while retaining the ability to explain the rationale underlying automated decisions (just as a human would). An example would be a machine deciding which customers meet multifaceted KYC requirements, then repeating this assessment as there are changes in customer profiles and available data. Such a system would be the “brain” into which all other systems plug, so you can get that unified view banks want and provide the seamless experience customers crave.

Intelligent automation, such as Rainbird, sits within the artificial intelligence (AI) space and takes a “human down”, not “data up”, approach to automation. That means we start with human knowledge and apply it to data (so that humans can always understand and explain what the machines are doing). All the logic, ambiguity and rationality behind a specialised human-made decision is combined with data to automate complex human decisions, at scale.

You will be able to dramatically speed up the process of customer onboarding, as intelligent automation can work across siloed divisions, while taking many factors into account and weighing them in a nuanced and efficient manner. False positives can also be reduced, therefore minimising the need for manual investigation.

Intelligent automation systems are also fully transparent, allowing banks and their customers to find out exactly how and why decisions have been made, and which data points were considered. This will instil greater trust in your customers, providing them with complete transparency into decisions or recommendations made about financial products. This can also reduce compliance costs.

The accuracy of customer data is key to ensuring efficient KYC. Where your KYC analysts may be prone to human error or customer data is outdated (due to information silos), intelligent automation software can make decisions despite uncertainty and missing data—it can even gather new information to update erroneous data. Its ability to work with uncertainty will also mitigate potential fraud, by identifying high-risk customers early in the onboarding cycle.

Download our free eBook to find out how intelligent automation can make ongoing KYC a success in your organisation.