This blog post explains why our model of intelligent automation for KYC is essential to adopt, and how it works.

____

To meet today’s challenges, every AML programme needs a robust KYC software stack that can make intelligent decisions about whether to onboard new customers and how frequently to monitor them.

Our model of intelligent automation for KYC is essential to adopt. This is because it has key benefits that you won’t find with common point-to-point technologies. Nor will you find them with analysis-based technologies, such as machine learning algorithms.

Our model will give you these key benefits:

- You’ll be able to get a percentage score for the level of risk each customer poses (so that you’ll have a clearer picture of who you are onboarding and won’t rule out perfectly good customers). This means fewer wasted revenue opportunities.

- You’ll be able to easily explain how automated decisions are made—and trace the important factors in making those decisions to relevant regulations. This means you’ll keep regulators like the FCA and ICO happy.

- Your KYC processes will be more accurate and much faster than using big teams and legacy technologies. This means you can improve the operational efficiency of your department while improving work output.

The automated KYC process

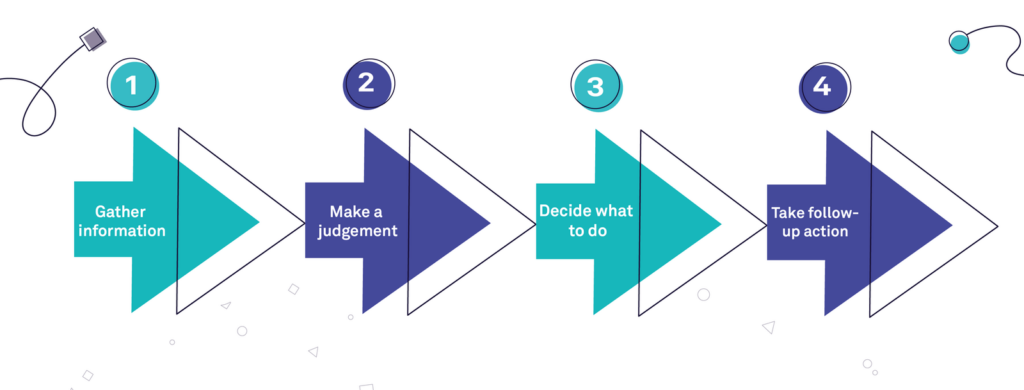

Before diving into the KYC software stack that makes up our model, let’s go over the fundamental steps common to any KYC onboarding process. Here’s what you need to do when you are deciding whether or not to onboard a new customer:

First, you need to gather (necessary) information on that customer.

Then, you need to make a judgement about what kind of risk level that customer might pose and decide what to do with their application (ensuring you can be transparent about how the decision was made).

Lastly, you need to take follow-up action(s), informed by initial information gathering as well as ongoing monitoring of information on that customer. This can be tailored to how your organisation would typically map a customer’s risk.

The underlying KYC software stack that makes these four steps possible

The stack

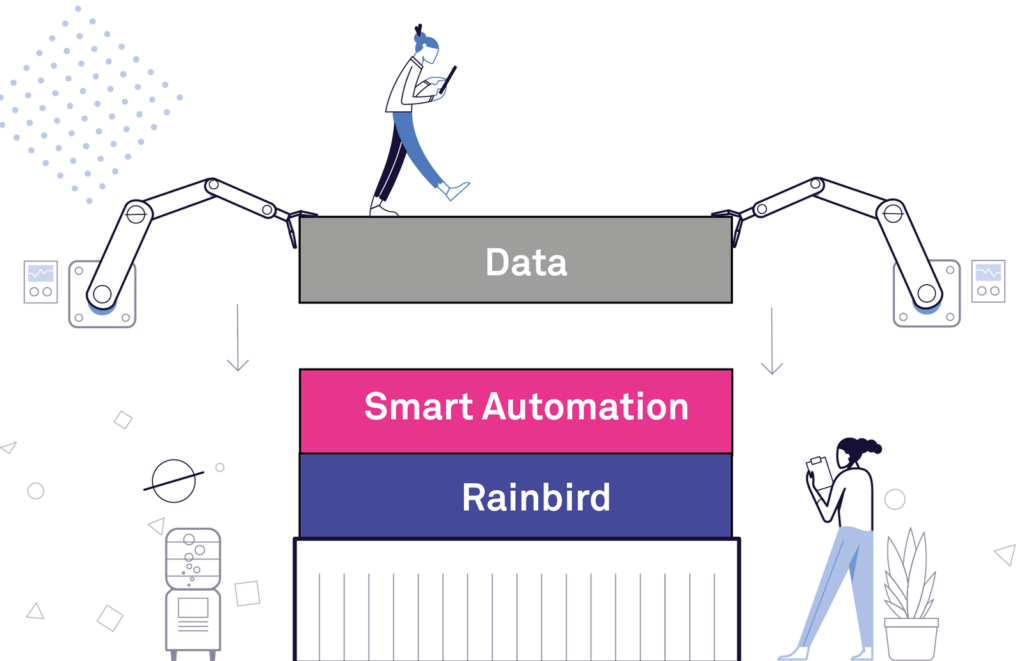

Rainbird has teamed up with Smart Automation to create a KYC software solution that allows KYC operations managers to achieve and automate these four steps—only with superhuman speed and accuracy (at a fraction of the cost of legacy systems). It also gives you total transparency over the decisions made about each customer.

Data (via an integration layer): Data are the ingredients of the entire process. In the stack, data comes from form entry information (when a customer signs up) and from external sources (such as those relating to PEP, sanction lists and credit ratings).

Smart Automation: Using tools by Blue Prism (a robotic process automation (RPA) provider), Smart Automation’s role is to collect and manage data.

Rainbird: Rainbird is the decision automation engine that adds a layer of cognitive reasoning to the stack (this process is called intelligent automation).

The stack in action

Let’s now see how the KYC process works in practice.

Set up:

Prior to starting to process applications, you’ll have set up a knowledge map in Rainbird. What this means is that you can visually encode the knowledge of your best KYC analyst(s), during a process similar to mind mapping, so you can digitally replicate them.

1. Gather information

Smart Automation collects customer data using an online customer-facing form. This information is retained in an integration layer, like a spreadsheet. Then, Smart Automation uses Blue Prism digital workers to run checks on external sources of data, such as politically exposed persons (PEP) lists, to see if there are any matches.

Smart Automation then passes all the necessary information about each customer to Rainbird via an API.

2. Make a judgement

Put simply, this is where ‘intelligent’ comes into ‘intelligent automation’. Using all the information provided, Rainbird reasons over the data for each customer in the same way your best KYC decision-maker would. Then, Rainbird makes a judgement. That judgement allows your KYC team to see for each customer:

- A risk score—as in, a percentage of how much risk that customer would pose if onboarded.

- A certainty factor for that risk score—as in, how certain Rainbird is that the score it has assigned each customer accurately reflects the level of risk posed by that customer.

- A suggested monitoring frequency for that customer (to maintain compliance with money laundering regulations across jurisdictions).

3. Decide what to do

This score and certainty level will then determine what happens next—based on rules that you encode in Rainbird and can always control or change. For instance, a customer could be onboarded…or they could be rejected…or their application could trigger enhanced due diligence (EDD) checks and be flagged to your KYC team—the key is, this decision can be set up to mimic the gold standard of your own KYC procedures.

4. Take follow-up action

Depending on what decision is made, Smart Automation then uses Blue Prism to carry out the appropriate tasks. For instance, it can send notifications to customers or notify your KYC team that EDD checks are needed.

***

Ongoing monitoring

The regulators are getting tougher on AML; they need firms to do more. Especially now. That’s why we’re seeing new obligations mandated, like those requiring firms to monitor customers on an ongoing basis—not just at onboarding. In short, the case for digital transformation couldn’t be stronger.

Once a customer is onboarded, our model of intelligent automation for KYC lets you easily make updates and upgrades to its setup (for example, if regulations are tweaked or tightened). So, you can be sure you’re applying the same fair, consistent process to every customer, at every stage of their journey. Indeed, the process would be the same as described above if you wanted to run checks on the customers you already have.