Decision Intelligence powered by AI the world can trust

Close the gap between data and action.

Talk to us about how Rainbird automates complex and

situational human decision-making with trust baked-in.

Transform Decision Intelligence with Rainbird’s advanced reasoning engine

Our Decision Intelligence platform enables the automation of complex decision-making with explainability and trust baked-in.

Lean on our decade of experience delivering next-generation trusted Decision Intelligence and automation in financial services, tax, legal, healthcare, biotech, compliance, and more.

Build Trustworthy AI models that automate complex decision-making

We ensure explainability, traceability and reliability—completely eliminating the hallucination and explainability challenges of LLMs.

Our approach enables models to start from knowledge, avoiding the limitation of needing to be “data first”.

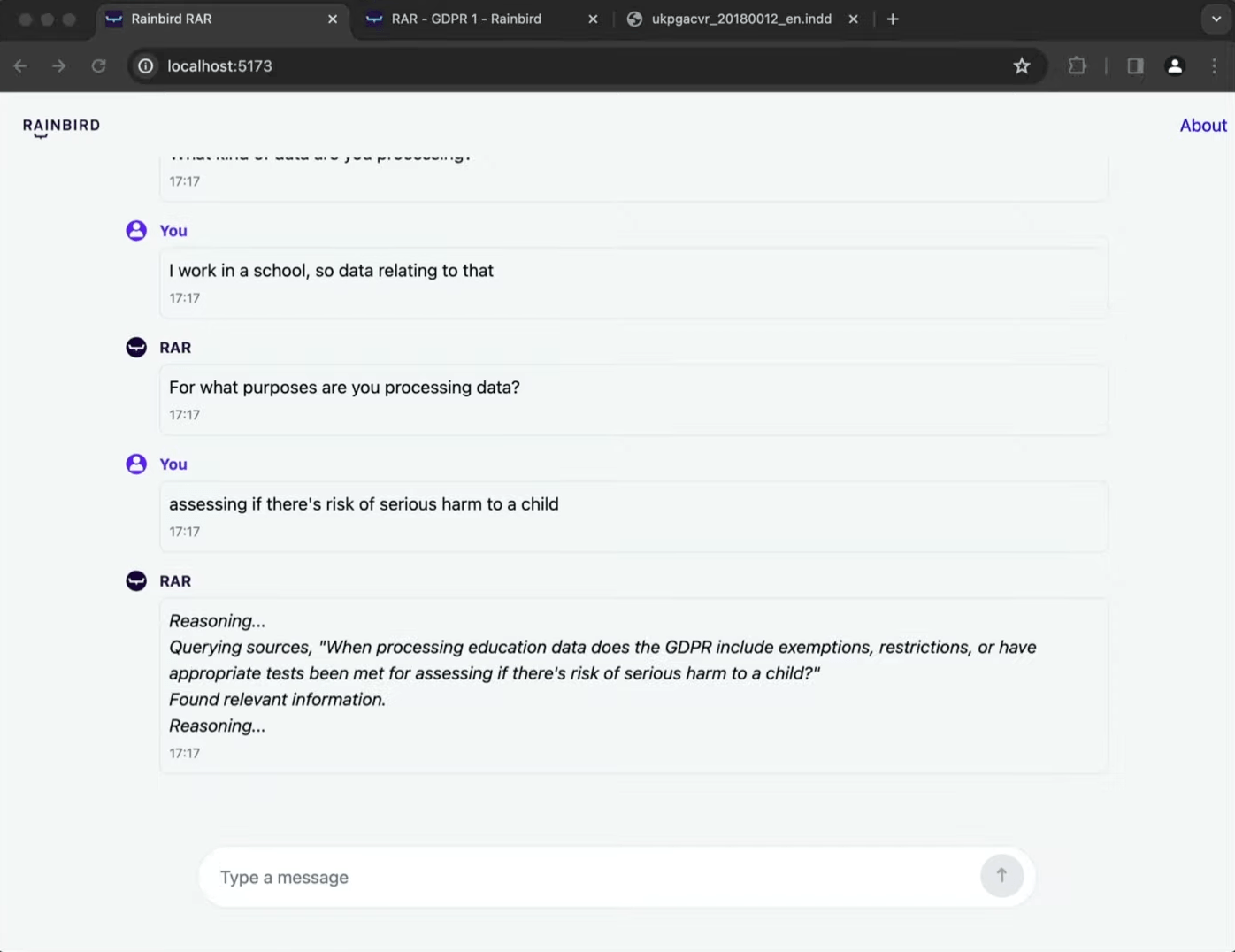

Rainbird also supports natural language consultation, enabling a new generation of trustworthy AI-powered digital services.

Learn more about our platform.

Bridge data and process with Rainbird Decision Intelligence

Data and process people agree on their desire to bring intelligence and automation to human decision-making.

Rainbird leverages your data but still thrives in low data environments. It avoids bias and ensures that your AI-powered decisions are explainable, reliable and traceable.

Read about how our clients have achieved unprecedented success with Rainbird and delivered market leading AI-powered products and services.

You’re in good company

Transform your business into a Decision Intelligence powerhouse

Explore how Rainbird can seamlessly integrate human expertise into every decision-making process. Embrace the future of Decision Intelligence powered by explainable AI.